Value

If you’re doing business in the U.S. or planning to, you’ll need an Individual Taxpayer Identification Number (ITIN) to ensure compliance with U.S. tax regulations. You can obtain your ITIN remotely and risk-free with E-Commerce.One. We are proud member of the Certified Acceptance Agent (CAA) program in Ukraine and Eastern Europe authorized by the IRS. This certification allows us to verify and certify clients' passports for ITIN issuance without requiring you to send original documents to the U.S.

Required documents for ITIN registration

Passport

Our certified agent will authenticate your passport and certify a copy.

Visa

If you have a U.S. visa, we’ll authenticate and certify a copy.

Form W-7

We prepare and file the necessary W-7 form on your behalf, so you don’t have to worry.

Supporting Documents

Proof of your need for an ITIN, such as a tax return or documents showing ownership of a U.S.-based company.

Apply for ITIN now!

Reviews about our service!

How to obtain ITIN with E-Commerce One?

Step-by-step registration plan

Our process has a flexible structure that adapts, evolves and meets your needs. A simple 6-Step process.

- 01.

Filling out the application form

To get started, you need to fill out an online form, which will only take a few minutes.

- 02.

Collecting the necessary documents

Upload your documents to our secure portal for processing your application.

- 03.

Video Interview

A short interview to confirm the identity of the applicant for an ITIN number can be conducted online via Skype, Telegram or Zoom. The interview will only take a few minutes.

- 04.

W-7 Preparation

Our experts will certify your documents and prepare the W-7 form for your signature.

- 05.

Sending the application to IRS

E-Commerce.One submits your application to the IRS for review and processing.

- 06.

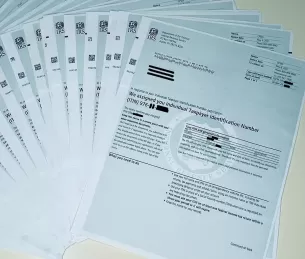

Receive Your ITIN

Once approved, your ITIN will be available in your account, and we’ll mail you the original document. Congratulations—you’re now ready to explore U.S. financial opportunities!

Subscribe to receive a 15% OFF!

Why choose E-Commerce.One for ITIN processing?

Certified Acceptance Agent (CAA)

We're the only company in Ukraine that is a Certified Acceptance Agent (CAA) for IRS. Our partnership with the Internal Revenue Service(IRS) gives us the right to meet with people and certify their passports for a taxpayer number.

100% Online Process

Obtain your ITIN from anywhere in the world without visiting the U.S, completely online. There is no need to fly to the USA or look for the nearest embassy.

Fast & Efficient Service

Our process reduces the typical wait time. Get your ITIN in just 40-60 business days, with our team's expertise ensuring accuracy and speed.

FAQ

ITIN (Individual Taxpayer Identification Number) is a personal taxpayer identification number in the USA, which is issued to non-residents for tax reporting and income tax purposes.

An ITIN is needed for anyone who is not a U.S. citizen and is not eligible for a Social Security Number. The most common reasons include:

- Filing tax returns and paying taxes;

- Requiring a foreign spouse, children or dependents on a tax return;

- Opening a bank account in the U.S. (personal or commercial);

- Opening a business or becoming a member of an LLC;

- Owning and investing in real estate in the United States;

- Eligibility for a reduced tax withholding rate under a tax treaty;

- Applying for a job with a U.S. employer, mortgage or credit card, renting an apartment, etc;

ITIN is issued to non-residents subject to U.S. taxation requirements and not eligible for an SSN.

The application for the ITIN number package includes:

● A completed Form W-7.

● Original identification documents or certified copies issued by a Certified Acceptance Agent.

● A completed U.S. tax return (may not be required for some cases).

● Other documentation for exemptions (if applicable).

Yes, you can get certified copies of your foreign identification at the U.S. Embassy. However, you will still have to fill out a W-7 and collect all the necessary documents yourself. Most ITIN applications are rejected because of errors in the W-7 form. To avoid the risk of rejection, use a certified IRS intake agent to make sure your application for ITIN number is submitted correctly the first time!

TINs that have not been included on your U.S. federal tax return at least once in the last three consecutive tax years will expire. If your ITIN has not been included on your tax return at least once for tax years 2019, 2020 or 2022, your ITIN will expire on December 31, 2022.

It takes up to three months to register for an ITIN in the United States. But we know how to speed up the process. Thanks to the experienced professionals at E-Commerce.One, you can get your personal tax identification number (ITIN) in 45 business days.

We offer a 100% money-back guarantee. If for any reason your ITIN application goes unanswered, we will refund your money immediately, no questions asked. Thus, we take all the risks.

No, you do NOT need to send your original passport to the IRS if you are working with a Certified Acceptance Agent. Since we are a Certified Acceptance Agent, we will certify a copy of your passport, so you do not have to send the original.

No, the IRS only accepts original documents or certified copies. The IRS can keep your original documents for up to 60 days, but E-Commerce.One is an IRS Certified Acceptance Agent (CAA) and can provide certified copies with your application.

The ITIN is the counterpart to the SSN and is issued to non-residents who are subject to US tax requirements and are not eligible for an SSN.

All three numbers are unique identifiers (Tax Id) for taxpayers, but differ as follows:

- ITIN — For non-residents filing U.S. taxes.

- EIN — For businesses and employers.

- SSN — For U.S. residents and citizens.

We offer a 100% money-back guarantee if we do not receive a response regarding your W7 application from the IRS. However, this has never happened in our practice, as we have successfully processed over 3,700 W7 applications to date.