Value

The U.S. tax process requires meticulous record-keeping and timely reporting to the IRS in compliance with all regulations. Don’t delay — contact the E-Commerce.One team to ensure accurate bookkeeping, on-time tax payments, and hassle-free tax refunds.

Required documents for tax refunds for individuals and single member LLC

Passport or ID

A copy of the passport or ID card of the individual filing the tax return.

SSN (Social Security Number) or ITIN

A personal tax identification number, either SSN or ITIN. If you don’t have either, no problem—we’ll assist you in obtaining an ITIN.

Annual tax forms and documents

If you worked for someone, you'll need Form W-2 or Form 1099-NEC. If you were involved in trade or commerce, you may need Form 1099-K or other applicable forms.

Business Expenses(if any)

Primary financial documentation(receipts, paystubs and etc.) or a prepared Profit & Loss report.

Dates of all visits to the USA in the last 3 years (if any)

Our software will help you determine your tax status in the USA and provide recommendations on tax benefits you can utilize.

Who can we help?

We assist not only with tax filings for businesses but also with recovering overpaid taxes for individuals who worked in the U.S. as resident and non-residents. This includes those who legally worked in the U.S. within the last four years under programs or contracts such as Work and Travel USA, Uniting for Ukraine, Training USA, Internship USA, MAST International, H1B, or H2B.

Get a consultation for your Tax Return or business tax fillings!

How to file tax return?

Step-by-step registration plan

E-Commerce.One makes preparing your taxes hassle free and affordable. Our unique online software incorporates most up-to-date nonresident tax laws and regulations along with a user-friendly navigation.

- 01.

Complete the application

Fill out the application form on our website, it takes only a few minutes.

- 02.

Gather the required documents

Upload the necessary documents to your personal account to initiate the processing of your application.

- 03.

Document review and Tax Return preparation

Our specialists will review your documents, prepare your annual tax return, and send it to you for approval.

- 04.

Submission to the IRS and feedback

Once approved, the tax return is submitted to the IRS. Copies of the filing will be uploaded to your personal account. We’ll notify you once the IRS accepts your return.

- 05.

Refund processing (if applicable)

If you’ve overpaid taxes, you can track the refund process in your personal account. Refunds typically take 1 to 3 months to process.

- 06.

Receive your Tax Refund

We’ll inform you when your refund is successfully issued. You’ll also see the updated status in your personal account. Refunds can be sent to your specified account or issued via check.

Features of Tax Returns for companies in the U.S

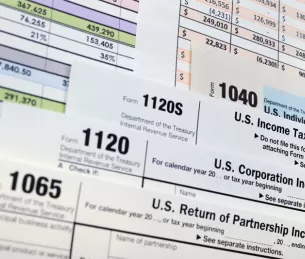

Filing a tax return is an annual requirement for companies, allowing the IRS to determine the amount of taxes owed based on the company’s profits. The process and forms required depend on the type of company structure:

- C-Corporation: Files using Form 1120.

- S-Corporation: Files using Form 1120S.

- Partnerships: File through Form 1065.

To properly prepare a tax return, it is important to keep detailed records of your company's income (sales, services) and expenses (salaries, rent, materials, depreciation, etc.). By ordering a tax return filing service through Ecommerce-One, you will save yourself from routine work and hassle, and you will also be sure that the tax return will be filed with the IRS on time.

Reviews

Subscribe to receive a 15% OFF!

Advantages of working with E-Commerce.One

Extensive Experience in Taxation

Over 40,000 individual tax returns and more than 9,000 business tax returns filed. Experienced CPAs and EAs are always here to assist you!

IRS Certified Acceptance Agent

We are the only company in Ukraine certified as a Certified Acceptance Agent (CAA) for the IRS.

Sales Tax Services and Accounting

We provide preparation and filing services for Sales Tax reports across all U.S. states. Additionally, we assist in setting up your sales platform to collect taxes from customers.

CFC (Controlled Foreign Corporation) Services

We assist with the preparation and submission of: notifications regarding the acquisition and disposal of shares in a Controlled Foreign Corporation (CFC); CFC reporting; Individual tax declarations for CFC controllers.

Saving Your Time!

You no longer need to spend hours searching for relevant information online, studying the complex U.S. tax systems, or hiring an in-house accountant. Instead, you can leverage our team's expertise, save your time, and rest assured of a successful outcome.

From Anywhere in the World!

The document submission process is conducted online through a user-friendly personal account with our proprietary automated document workflow system. This allows you to be anywhere in the world while tracking the status of your tax return submission in real time!

FAQ

Generally, tax returns must be filed by April 15. Extensions are available if the necessary application is submitted on time.

If you own an LLC and are registered as a sole proprietor, you must file the tax return by the 4th month after the end of the year. The deadline is the 15th.

For LLCs with multiple owners, filing reports with the IRS involves multiple deadlines. Form 1065 must be prepared by the 15th of the 3rd month, and the deadline for Form 1040 NR, which each owner of the company must file, ends exactly one month later.

If you own a C-corporation, your deadline is the 15th of the 4th month after the end of the tax year.

Displaced persons from Ukraine under TPS and U4U programm may be eligible to claim a tax refund on the wages they earned in America.

If a company fails to file a tax return or pays taxes late, it may incur penalties and interest charges.

Yes, you need a Social Security Number (SSN) to file a tax return. If you do not have one, you will need to obtain an ITIN. Our team can assist you in obtaining an ITIN.

In addition to federal taxes, companies may also be required to pay taxes at the state or local level, which necessitates filing additional tax returns.

The amount of tax refund from the USA depends on various factors, such as the amount of taxes paid, income level, residency status, and available tax benefits. The exact refund amount can only be determined after analyzing your tax return and supporting documents. Based on our clients' experience, the expected refund amount can reach up to 100%.

The process usually takes 2 to 4 months from the moment the electronic tax return is filed. After receiving your documents, we promptly review them, prepare tax refund applications, and submit them to the IRS. Throughout the process, we keep you informed about any updates via your personal account on our website.

If you legally worked in the USA no more than 3 years ago, you can claim a tax refund.

You can still initiate the tax refund process even without all the necessary documents. Consult with our specialist individually, and we will find a solution tailored to your specific situation.

The cost of filing a tax return is calculated individually and depends on the complexity of your specific situation. The price for preparing a tax return, including business-related filings, starts at $250. The service for obtaining a tax identification number starts at $400. If you are claiming a refund for taxes paid in the USA, the service cost starts at $150.